作者:佚名 来源于:中国VI设计知识网

但去年,戴女士坐了两个小时的飞机到海南三亚购物,并通过网络平台购物。去年,她在购买奢侈品上花费了100多万元人民币(约15万美元),比2019年还多。

But last year,Dai took a two-hour flight to the Hainan city of Sanya to shop, and to do soturned to online platforms. Her spending on luxury items topped Rmb1m($150,000) last year, more than in 2019.

“在疫情爆发之前,我确实更喜欢出国购物,或偶尔通过海外代购渠道购买产品,”她表示,“疫情爆发后,我就开始在国内零售商那里购买了,这样我才能在第一时间买到最新的产品。”

“Before thepandemic, I did prefer going abroad or occasionally I would buy from overseaspurchasing agents,” she said. “Since the pandemic started I’ve switched todomestic retailers, because otherwise I can’t get the latest editions in time.”

根据贝恩的数据,去年全球奢侈品销售额为2170亿欧元,下降了约五分之一。在经历了艰难的2020年后,奢侈品行业正指望中国消费者推动复苏。

The luxurysector is counting on Chinese consumers to fuel the recovery after a difficult2020 in which sales contracted by roughly a fifth to €217bn globally, accordingto Bain.

中国相对成功地遏制了疫情,经济迅速复苏——去年第四季度,中国国内生产总值(GDP)增长已经恢复到疫情爆发前的水平——这对于维持针对全球经济增长的乐观情绪发挥了关键作用。

China’scomparatively successful suppression of the virus and rapid economic recovery —gross domestic product growth returned to pre-pandemic levels in the fourthquarter — played a pivotal role in maintaining optimism.

复苏最初是由“报复性购物”促成的,或者说是在世界上人口最多的国家摆脱全国封锁后的放纵,但之后出现了更为持久的复苏动力。

The recovery wasinitially spurred by “revenge shopping”, or indulging after the world’s mostpopulous country emerged from a nationwide lockdown, but has since given way tosomething more durable.

一家欧洲品牌驻北京的员工表示:“有很多富人在高增长行业工作或持有表现良好的股票。他们从疫情中受益。”该人士补充说,高端珠宝已经“卖疯了”。

“There areplenty of rich people who have benefited from the pandemic as they work in high-growthindustries or own well-performing stocks,” said a Beijing-based employee of aEuropean brand. High-end jewellery, the person added, was “selling like crazy”.

疫情还加速了中国奢侈品市场正在发生的转变,比如电子商务的扩张,进口关税的降低,以及对由“代购”推动的灰色市场采取更加严格的管制。“代购”是一些专业买家的简称,这些人代替中国大陆人在海外购买手表、珠宝、服装和化妆品等产品。在过去,在中国销售的商品要比在欧洲或美国销售的商品贵得多,而如今,各大品牌已经开始着手缩小这种价格差异。

The pandemicalso accelerated shifts that were under way in China’s luxury market, such asthe expansion of ecommerce, lower import duties and tighter controls over thegrey market driven by daigou, professional shoppers who buy watches, jewellery,clothes and cosmetics overseas on behalf of mainland Chinese. Brands hadalready begun narrowing the price differential that had made goods sold inChina more expensive than those stocked in Europe or the US.

这一趋势也促使奢侈品牌加大在中国的投资。

Such trends haveprompted luxury brands to invest more in China.

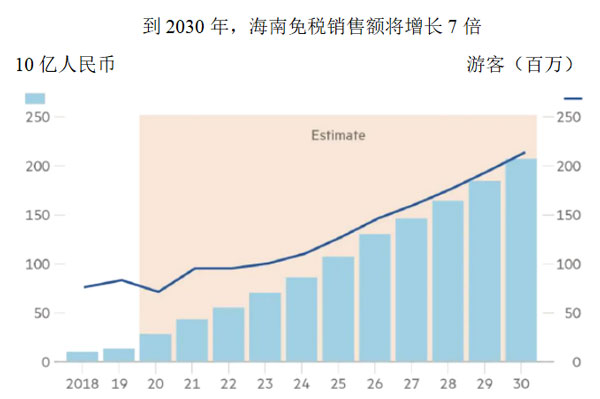

资料来源:海南海关;来自伯恩斯坦研究公司的预估和分析

杰富瑞(Jefferies)分析师的一份报告显示,只有路易威登(Louis Vuitton)、博柏利(Burberry)和古驰(Gucci)在中国最大的25个城市都开设了门店,这表明其他品牌在这方面可能需要“加把劲”。

A report fromJefferies analysts found that only Louis Vuitton, Burberry and Gucci had storesin all of China’s 25 biggest cities, suggesting that others might need toexpand their footprints.

对于这些国外品牌来说,让自己的产品在海南销售,可能是吸引更多中国消费者的一种有效方式。

Planting a flagin Hainan could be an effective way to get in front of more Chinese consumers.

日本化妆品品牌资生堂(Shiseido)计划在年底前,将其在海南的销售柜台数量增加一倍,增至60个。雅诗兰黛(Estée Lauder)也表示,消费者对其产品有强劲的需求。

Shiseido, theJapanese beauty brand, plans to double its sales counters on the island to 60by the end of the year. Estée Lauder also said it was experiencing strongdemand.

2/3 首页 上一页 1 2 3 下一页 尾页

上一篇: 珠宝首饰上市企业2020年市值排行榜-

下一篇: 行业动态 | 中国黄金披露首份年报,全球钻石矿企业绩普遍向好

【相关文章】

版权声明:文章观点仅代表作者观点,作为参考,不代表本站观点。部分文章来源于网络,如果网站中图片和文字侵犯了您的版权,请联系我们及时删除处理!转载本站内容,请注明转载网址、作者和出处,避免无谓的侵权纠纷。